Last Updated on November 29, 2023

Client Overview:

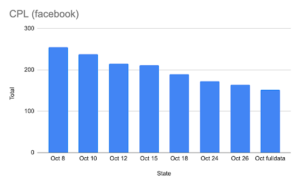

Our client is a prominent NBFC in India, operating since the 1950s, with a focus on gold loans. In recent years, the company diversified into various financial services, including vehicle and housing finance, microfinance, and SME lending. Despite its long-standing reputation, the client faced challenges with a significant spike in Cost per Lead (CPL), reaching as high as 254.

The Challenge:

The client’s main concern was the surge in CPL attributed to changes in campaigns and landing pages. Additionally, the ad account had over 50 campaigns with 300+ ad groups and 1500+ keywords, making it challenging to align keywords with ad copy for both Google and Meta platforms.

The Solution:

Meta:

1. Broad Audience Targeting:

Shifted from interest-based audience targeting to a broader audience approach. This strategy aimed to maximize campaign reach without limiting audience size, as the ads performed well with a broader audience.

2. Creative Refresh:

Replaced creatives with high frequency to maintain optimal engagement. Identified and replaced creatives with a frequency exceeding 4 to prevent ad fatigue.

3. Budget Reallocation:

Identified campaigns with the least CPL and good conversion rates. Redirected more budget towards these campaigns to increase qualified leads and reduce the cost per acquisition.

4. Remarketing Campaigns:

Implemented remarketing campaigns targeting users who visited pages beyond landing pages. Excluded users who already submitted leads to a focus on potential leads. This approach expanded the reach to more potential users and contributed to a reduction in overall CPL.

Google:

1. Budget Reallocation:

Similar to Meta, identified campaigns with the least CPL and high conversion rates. Increased budget allocation to these campaigns to maximize qualified leads and decrease the cost per acquisition.

2. Detailed Keyword Targeting:

Conducted state-wise keyword research for each campaign group. Identified the best-performing state-wise keywords and created separate ad sets for each category. Allocated separate UTM tracking for each to identify the best-performing ad sets and keywords.

3. Audience Optimization:

Identified the best-performing audiences and increased bids to ensure Google provided more leads from qualified audiences. This strategic move resulted in an increased number of qualified leads.

Results:

The implementation of these strategic measures led to a significant decrease in CPL for the client. By adopting a broader audience approach, refreshing creatives, reallocating budgets, implementing effective remarketing campaigns, and optimizing audience targeting and keywords, we achieved a more efficient and cost-effective performance marketing strategy.

Conclusion:

Our tailored solutions and comprehensive optimization strategies not only addressed the immediate concerns but also laid the foundation for sustained success in performance marketing for our NBFC client. This case study underscores the importance of continuous analysis, adaptation, and strategic decision-making in the dynamic landscape of digital marketing.